The original Death of SaaS essay from June 2024 was by far the most widely viewed piece of content I’ve ever created, reaching over 70,000 views across all platforms, generating lots of comments and even some debates, and attracting many of you as subscribers here.

So one year on, I thought it would make sense to revisit those claims. Is SaaS actually dead, or even ill? How can we tell?

Well, I made three claims that we can now review:

AI OS: Companies would start tossing out popular SaaS tools in favor of home-baked agentic AI workflows (what I call the “AI OS”)

Code as a Commodity: The cost of creating software would decline sharply

AI is eating Software: We should therefore expect pure-play SaaS companies to underperform

Claim 1: AI OS

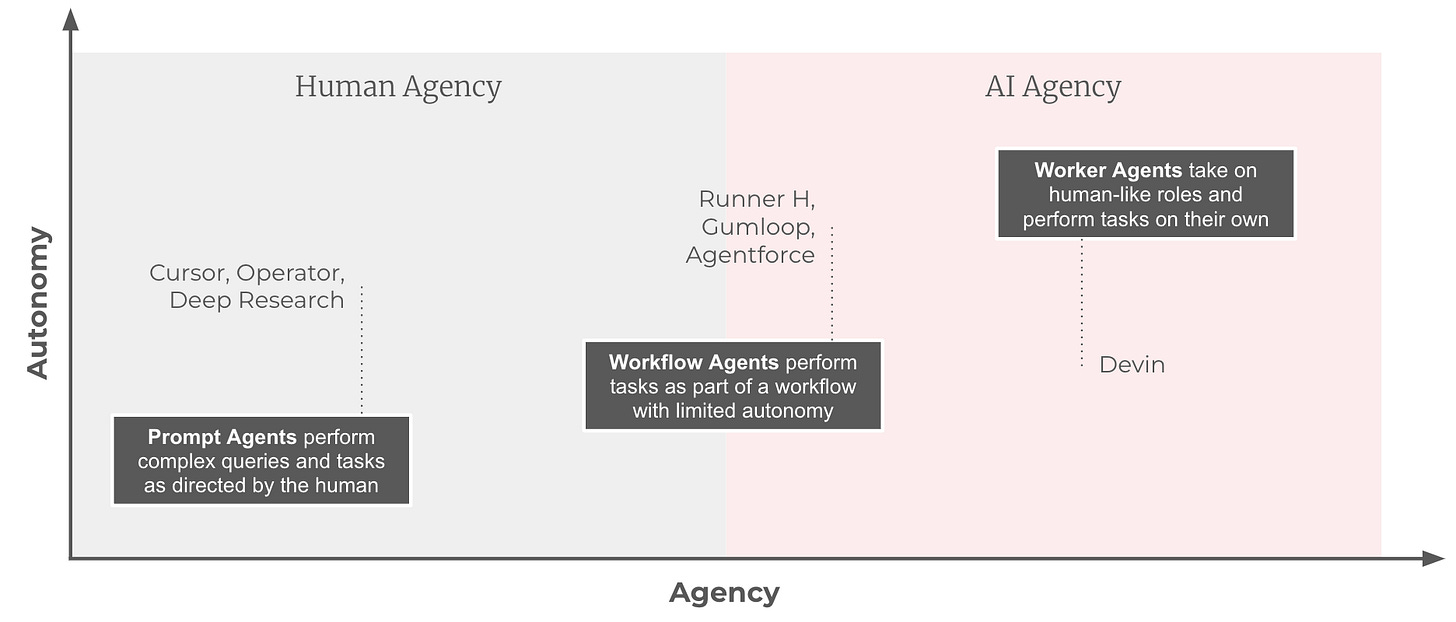

If you look at what’s happened in the last year, the major thematic change in AI has been the introduction of Agentic AI, which I covered in What Exactly Are AI Agents. I introduced this three-tier framework for separating what people actually mean when they use the word “agent”.

While Prompt Agents are still a thing and have gotten better, the real alpha has been in Workflow and Worker Agents. Platforms like n8n have mopped up tons of users with the promise of drag & drop workflows to connect AI Agents to your enterprise data. In the Worker Agent category, and relevant to this narrative, the main attraction is Coding Agents like Anthropic’s Claude Code and OpenAI’s Codex. More about those in the next section.

We’ve also seen major companies toss out their SaaS suites in favor of home-baked AI OS implementations. Klarna supposedly replaced 1,200+ SaaS tools with a combination of LLMs and knowledge graphs (Neo4j). The main reason this didn’t catch on immediately was that it’s hard. There are now playbooks or templates to switch off Salesforce and Workday. Klarna did it the hard way and made it happen.

At the same time, I would be surprised to see a new startup adopting Salesforce and Atlassian as its core productivity suite. You would probably start with open-source and agentic workflows. Well, I would.

Both of these trends together should show up in quarterly reports by now. More on that later.

Verdict: Plausible (early days)

As you might expect, the specific tools have changed, but the direction was correct. I foresee a lot more press releases like Klarna in the next months, as blueprints for the AI-native stack start to become common knowledge. Given the stakes and opportunity, I hope to see platforms that make it easier to transition to such knowledge graph based architectures.

Claim 2: Code as a Commodity

I also made some napkin math forecasts about how AI would lower the cost of creating code, based on different levels of AI improvement. I may have slightly underestimated here...

At least in terms of pure coding ability, it seems to me we’ve skipped a few years on this chart, as we’ve transitioned from code completion to full-on Coding Agents. Let’s try to quantify this step change.

Benchmarks

So, how much has AI actually improved in 12 months? The current way to measure AI progress is benchmarks, i.e. fun quizzes for LLMs.

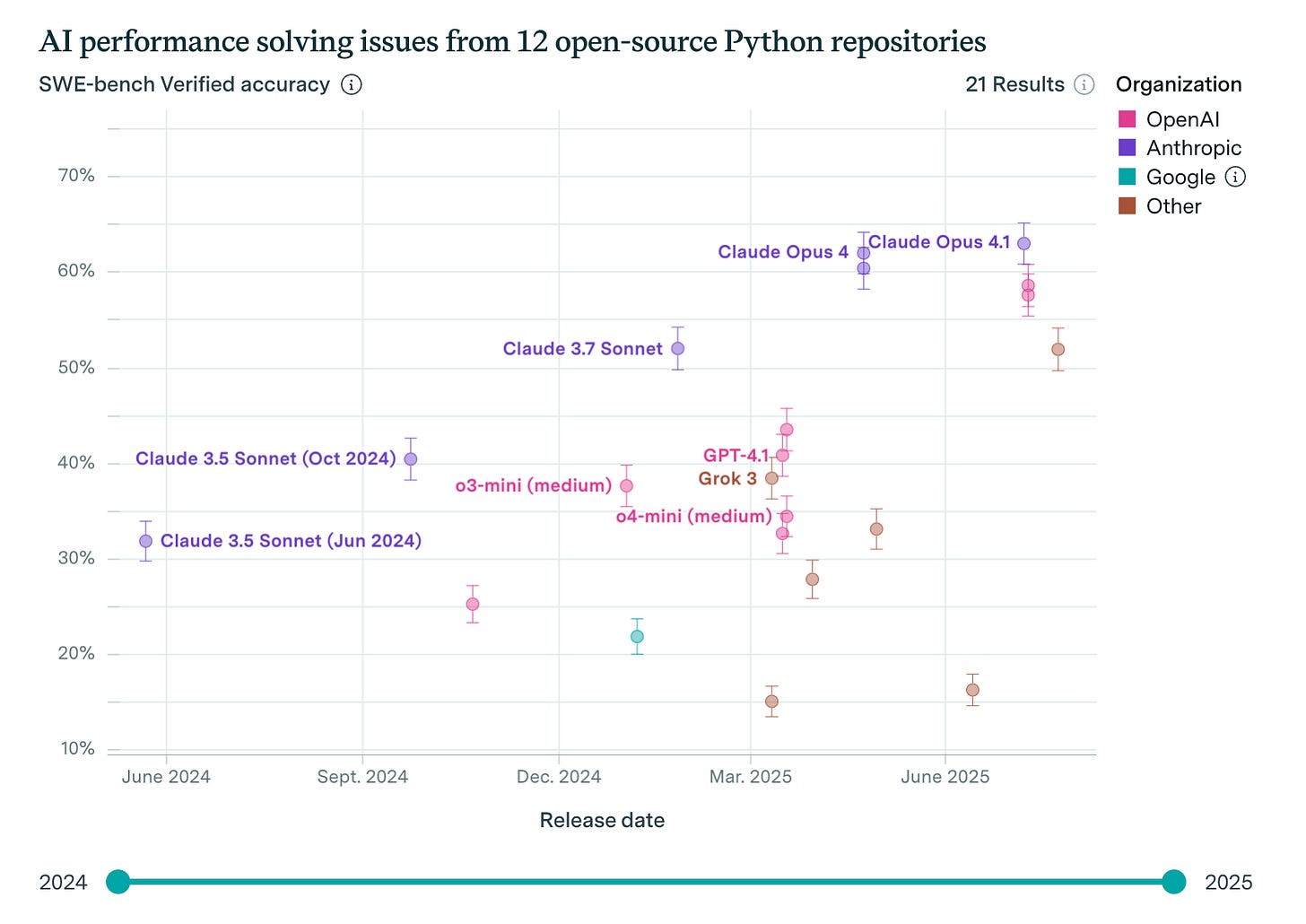

What we see here is basically a doubling in performance over the span of the last year. We’ve gone from 25% with GPT-4o to 60% with GPT-5. At this pace, software is a solved problem by 2026. But the real world isn’t formatted as questions and answers like a quiz.

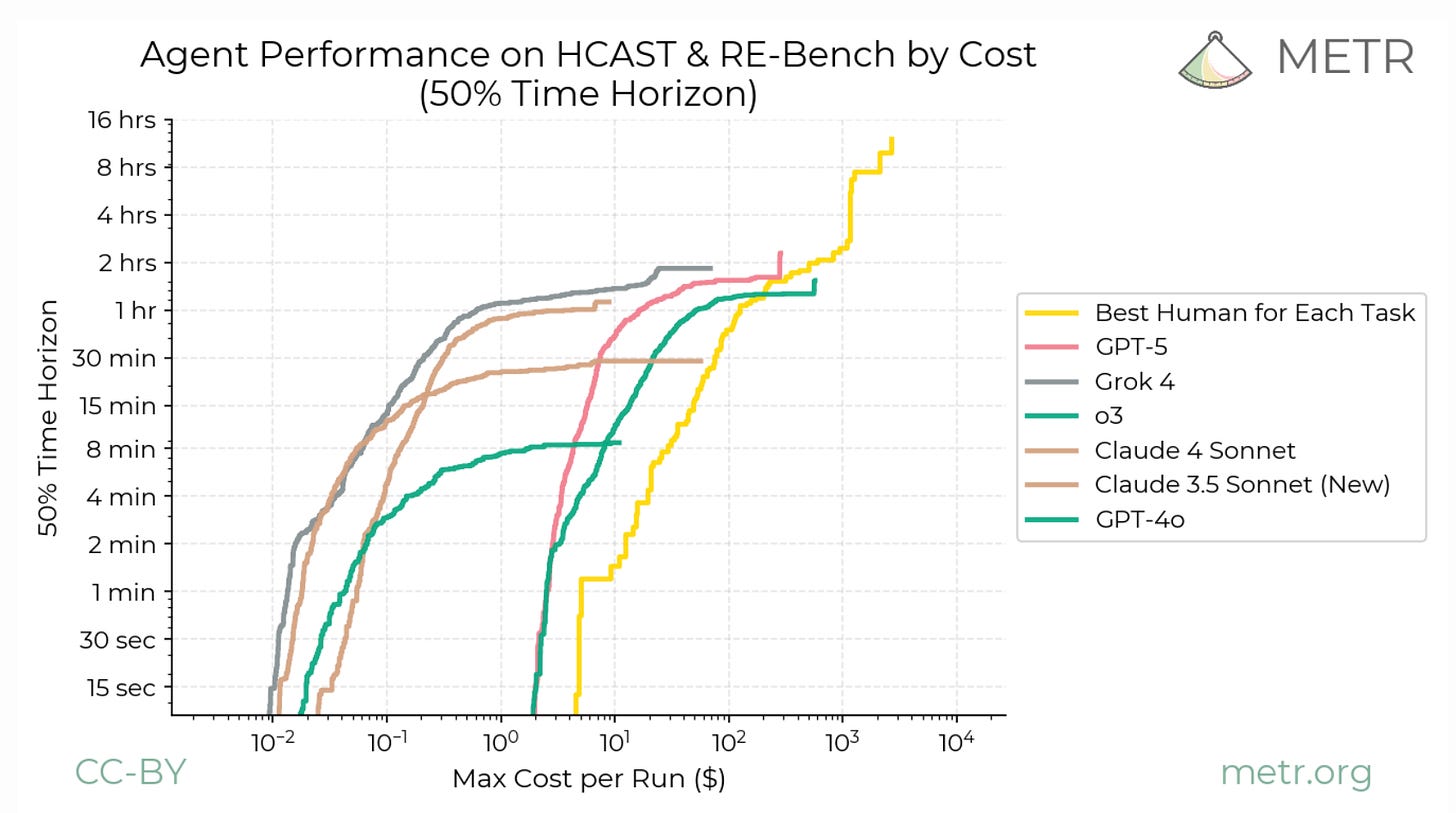

The way we measure agentic coding performance is to factor in the (human equivalent) length of tasks completed. In real-time, there is obviously a big difference in the absolute length of time the AI will stay on task. GPT-4o would usually do one thing, like changing a file, and spend less than a minute doing so.

Now, with the latest models like GPT-5-codex, you can easily witness dozens of edits across the entire repository, using command line tools, often running for 10-20 minutes at a time. It’s not just coding now; the AI is searching, planning, writing tests, running tests, and iterating until it’s satisfied that the original request is completed.

Anecdotally, the OpenAI team reported seeing up to 7-hour tasks being completed by the model! But is it actually cheaper?

Estimating Cost per LOC

It’s not as simple as cost per token. Because a code token output from GPT-4o is simply not the same as GPT-5. It’s hard to guesstimate how much extra effort an older model would have to make in terms of iteration to get the same result. The differences in model performance are so dramatic. After all, using the AI Agent framework above, GPT-4o wasn’t even agentic. Now with the latest generation, these LLMs come equipped with a whole host of tools, including virtual environments to run code and terminal commands. Obviously, GPT-5 includes reasoning tokens, tool use, and the chain-of-thought, so the token count will be many times higher. But then again, GPT-5 will “one-shot” many problems you would have to manually iterate countless times on with GPT-4o.

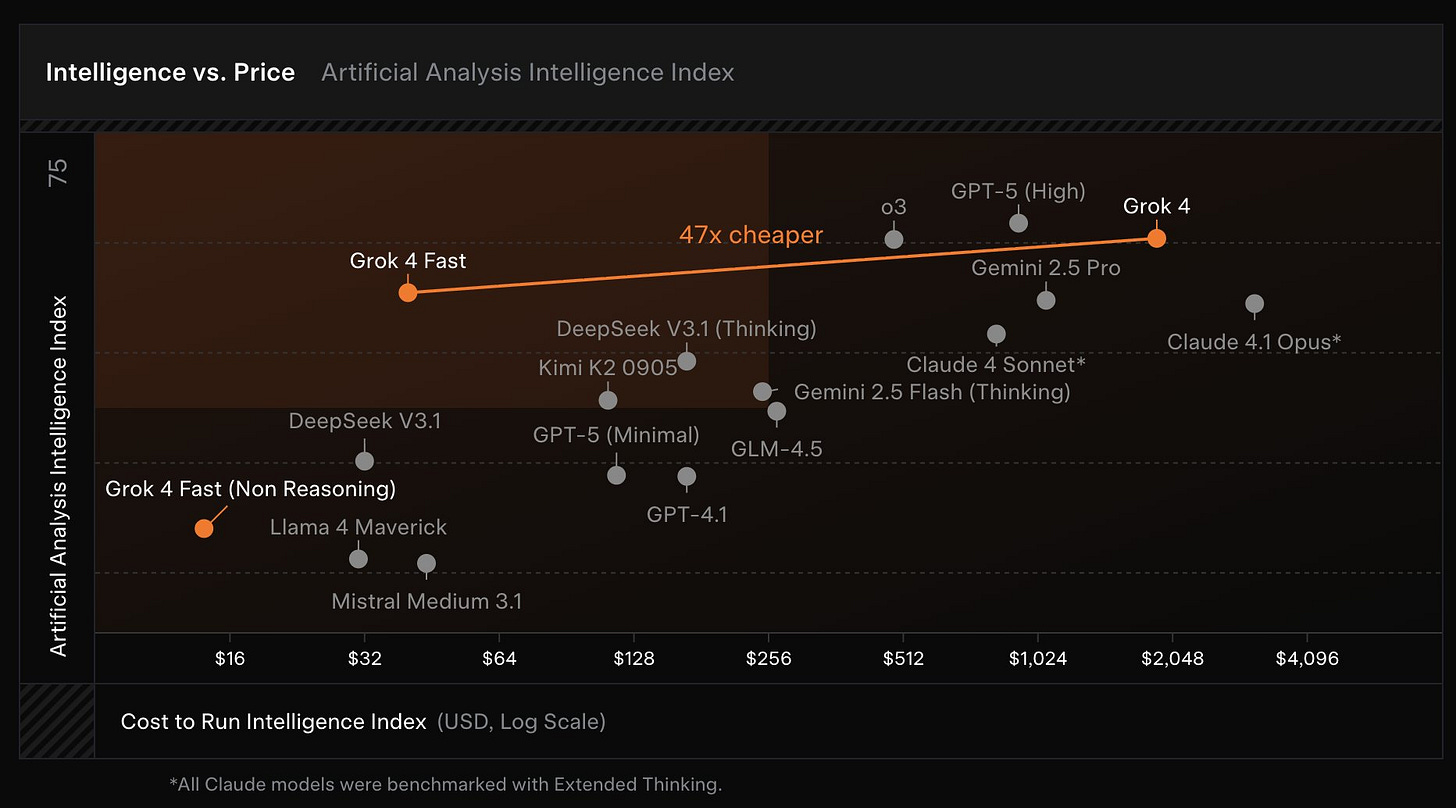

With the release of Grok-4 Fast, we’re finally seeing glimpses of “intelligence too cheap to meter”. Ironically, this model is from Sam Altman’s nemesis, Elon Musk. I expect Gemini’s upcoming third generation to further accelerate the price wars.

In reality, this is the harsh truth: we are beyond measuring cost per LOC anyway. Next is measuring cost per developer against AI. I wrote about this scenario in 2024 under the title The Code Canaries Are Singing. Do you hear them now?

I picked up this thread in my inaugural AGI Temperature Check, where we are starting to see reports and studies about the possible job displacement among junior developers. We can create tons more software and code, and still have less demand for developers. That’s the trajectory we’re on.

Verdict: Confirmed (off the scales)

I was right, but not right enough. Code is the #1 skill of LLMs, and they have doubled in both the quality and scope of their capabilities in the last year, while dropping the price point by 50x. The question is now: when will we see other agent skills beyond coding?

Claim 3: AI is eating Software

This final claim is the one where we can look at real data. I said that companies where the software is the product would struggle due to Claim 1 in particular. Conversely, companies where the service is the product, and software is just the delivery channel, would do well.

Here is the original table from the essay.

Let’s see how our contestants have fared since.

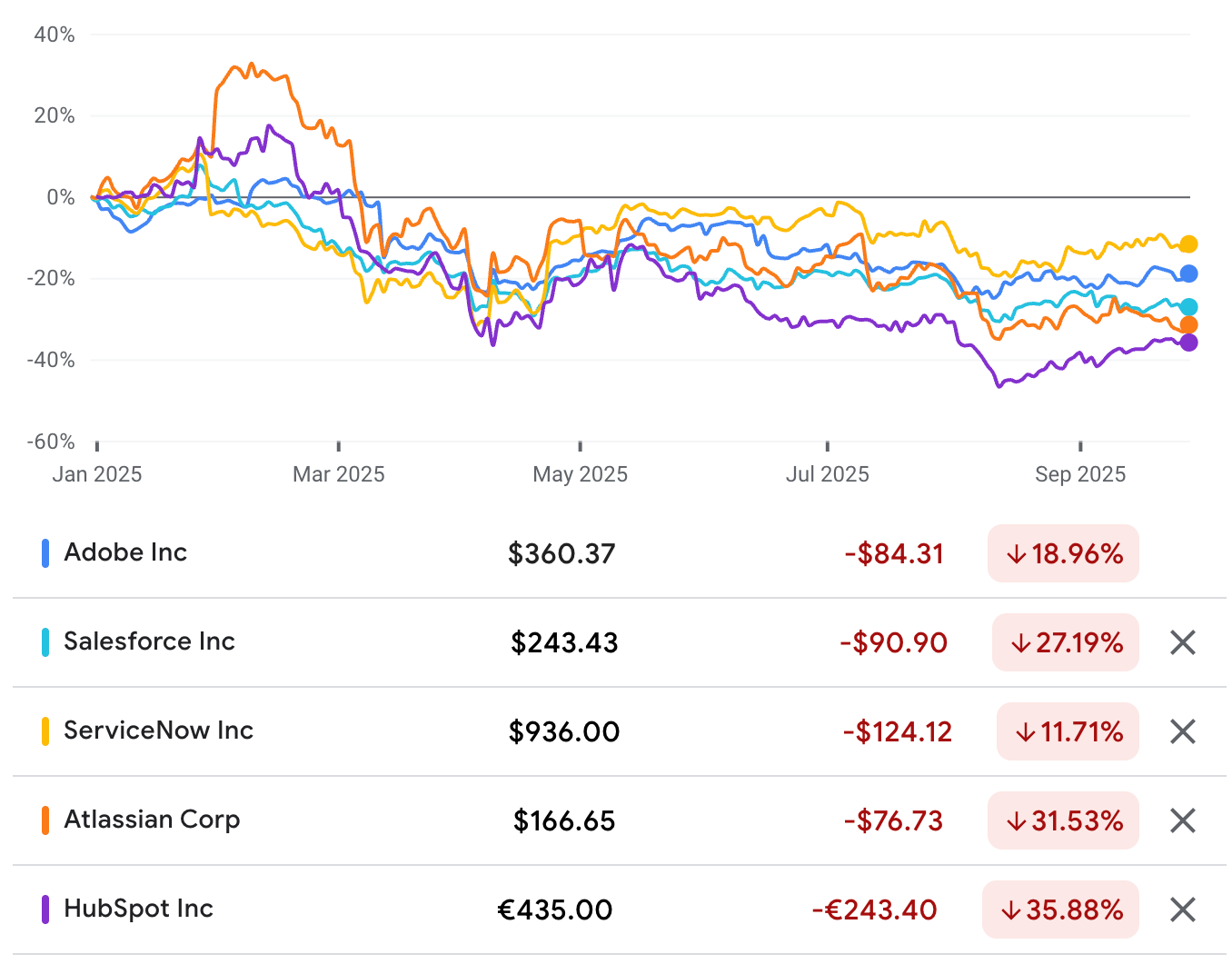

Software as a Service: Performance YTD

At the time of writing, the S&P 500 is at an all-time high, up 13.5% year-to-date (YTD). Not only has my list of SaaS companies underperformed the index, but they have all lost value.

Is this just about lack of hype, or are there cracks in the fundamentals already? Well, a cursory glance at Adobe, Salesforce, ServiceNow, and Atlassian shows them all growing double digits for Q1 and Q2 year-on-year. So if anything, it’s more so that investors are afraid that fundamentals will drop off in the future, combined with the fact that AI startups are growing orders of magnitude faster. So SaaS isn’t dying as much as it’s just being outcompeted, with a looming risk of extinction.

What about the better half of SaaS?

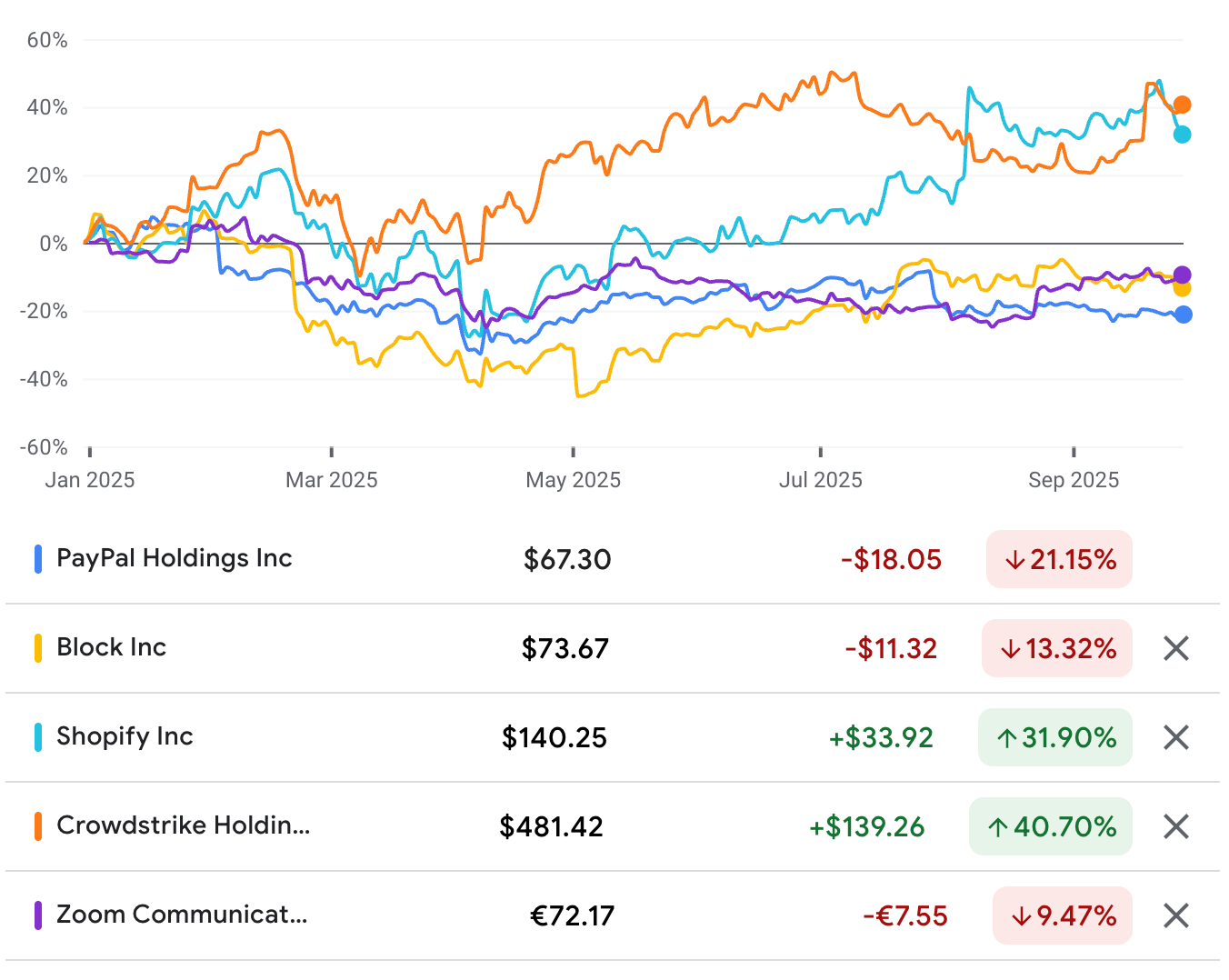

Service as a Software: Performance YTD

I took the liberty of renaming this category, thanks to a suggestion from a comment on the original post. It’s so obvious in retrospect, like all good ideas you wish you had.

Okay, so it’s mixed signals. Some have done incredibly well, but others are doing just as badly as the SaaS laggards. I could only fit five tickers in the chart, but Twilio and DocuSign have taken a beating, too.

What gives? Are these guys also getting disrupted, in this case by AI-native startups?

AI-native: startups vs. incumbents

All of the original companies I listed, with the exception of Stripe, are publicly listed companies. Traditionally, with any disruptive technology, there is a race between the incumbents and startups. The race is between startups capturing distribution channels and incumbents trying to innovate to keep up. Here’s a recent tweet from a16z partner Anjney Midha that summarizes this view.

AI is Eating Software

(Highly biased math) Across the handful frontier AI startups I’m an angel/board member in, YTD sales have gone from ~$1.3B to ~$8B+

Meanwhile, publics are bleeding

The single most rapid reallocation of value from legacy companies to startups in history?

— Anjney Midha (a16z)

To me, the story is not that clear-cut. Publics include Nvidia, for one, which also powers all startups, and has done pretty well in the last year. Second, it’s not as if startups themselves are somehow immune to the ongoing waves of AI disruption.

Remember LangChain or PineCone? Yeah, me neither. Remember that AI is eating software, all software. It’s not selective. I don’t see Cursor keeping on to their distribution moat, because they ultimately are just software, too. This is why “wrappers” are becoming less attractive to venture capitalists. If you started Cursor today, you might not even get funded.

The future of SaaS is probably more like Agents as a Service. That acronym is troublesome, unless you plan to be selling AaaS, so we may have to settle for Agentic SaaS.

From the incumbents’ side, someone like Stripe, with their payments foundation model, is very well-positioned to leverage their massive data moat in the payments domain. I would expect domain-specific “vertical” agents built on proprietary data to be the winning recipe.

With hindsight, companies like DocuSign, Twilio, and Zoom, which I had as winners 12 months ago, don’t seem to have data moats that would shield them from the fate of other software-heavy platforms.

Verdict: Confirmed (ongoing)

Certainly, 2025 has not been a good year for traditional SaaS. But AI progress is not a one-time event; it’s a relentless force with wave after wave of disruption. You can go from zero to hero and back again within the space of a single year.

If you look at the markets, the only confirmed winner so far is Nvidia. Everyone else still has to keep fighting for their existence for now. If a company like Salesforce ends up in the winner’s column, it’s certainly not by selling form-based CRM software.

SaaS is dead! Long live SaaS!

FYI: I’ve been working on AI Transformation for the past two years across 50+ startups, scaleups, corporates, and VC/PE funds. I’m starting to see enough repeatable patterns to put together some solution templates for things like evaluations for AI-readiness, workshops for use case discovery, and AI-native software development.

If you want to design & build an AI OS for your business, you can also reach out to me directly.